Yesterday there was a significant drop in the cryptocurrency market that ended up affecting the a large number of investors. This setback is believed to have occurred as a consequence of the Evergrande company scandal. In the next post we will explain what happened and the possible effects that this event will have on the market in the coming days.

¿What is Evergrande?

The China Evergrande Group is the second largest property developer in China in terms of sales volume. They are a company dedicated to the sale of apartments, specializing in the market for properties built for clients with a certain level of purchasing power (medium to high). Evergrande is part of the Global 500, which means it is also one of the largest companies in the world. The activities of this company account for 2% of China’s GDP, according to this article. For practical purposes it is one of the giants of the Chinese economy and of the entire world.

In the middle of 2021, a letter from the company was published informing the government of the province of Canton that the company is at risk of a liquidity crisis. This, of course, had its direct impact on the company’s share price.

As shown in the image, in 2021 the value of the company’s shares has fallen below the values it had 5 years ago. The situation of this company has worsened in recent months after the emergence of information about the company’s debts with thousands of small investors, as well as banks, suppliers and foreign investors. As of September 21, 2021, the real estate developer has liabilities that exceed RMB 2 billion, the equivalent of USD 310 billion, according to the Financial Times.

As shown in the image, in 2021 the value of the company’s shares has fallen below the values it had 5 years ago. The situation of this company has worsened in recent months after the emergence of information about the company’s debts with thousands of small investors, as well as banks, suppliers and foreign investors. As of September 21, 2021, the real estate developer has liabilities that exceed RMB 2 billion, the equivalent of USD 310 billion, according to the Financial Times.

What happened to cryptocurrencies yesterday?

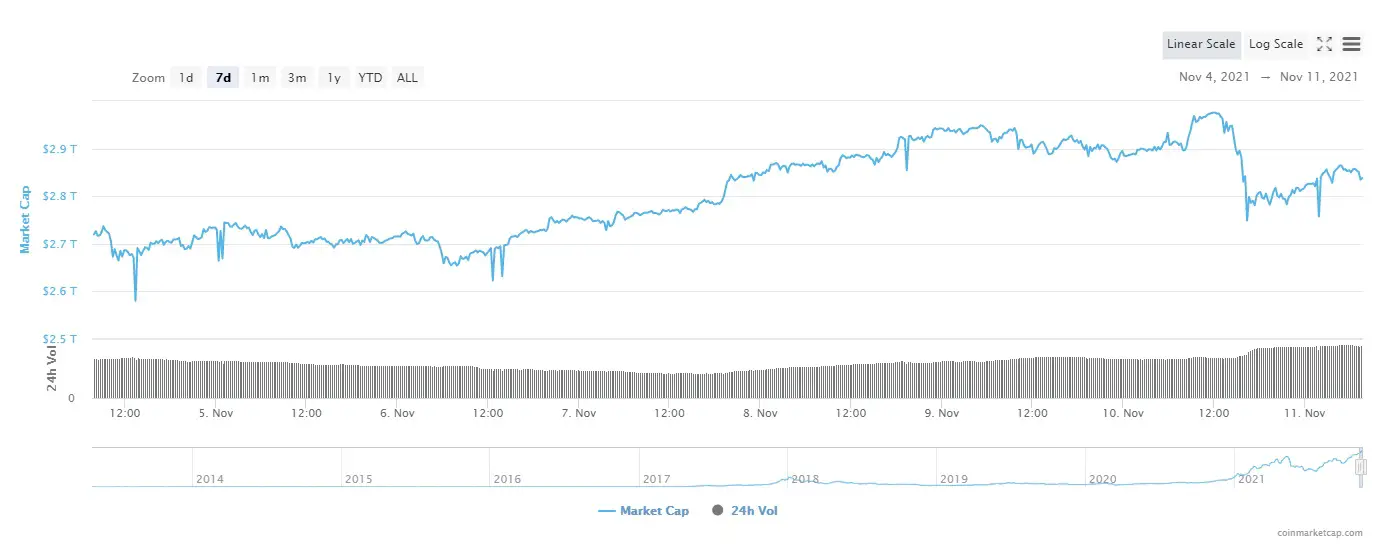

Yesterday there was a stumble in the cryptocurrency market, which is more than evident in the graph of the global market value:

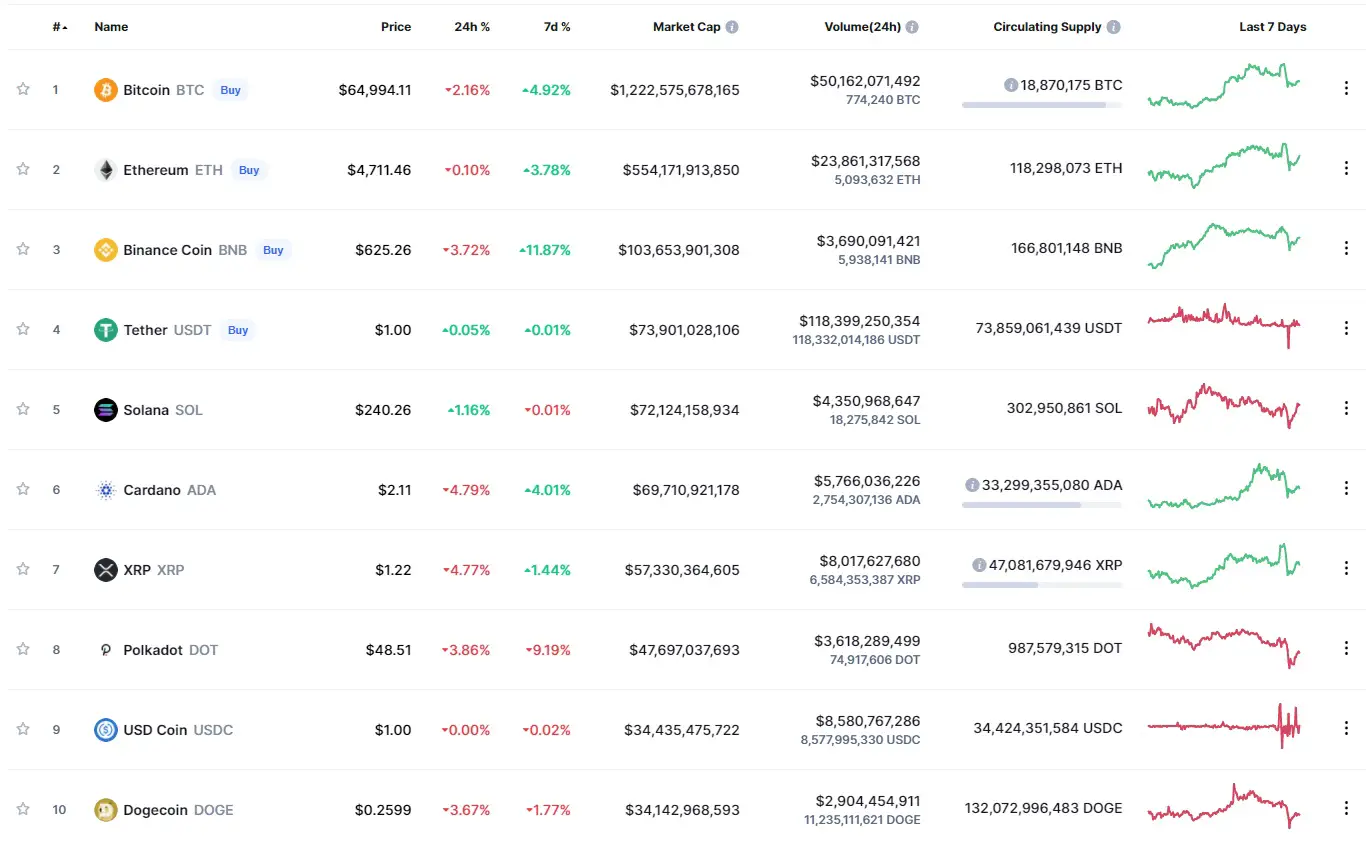

Bitcoin, like most of the major cryptocurrencies, suffered declines in the last 24 hours.

In my particular case, around 1:00 PM (EST) everything was fine. I went on a trip and by 6:00 PM my entire portfolio was in the red, with significant losses on almost all assets.

In my particular case, around 1:00 PM (EST) everything was fine. I went on a trip and by 6:00 PM my entire portfolio was in the red, with significant losses on almost all assets.

What happened?

Yesterday it was reported that the Evergrande company had failed to pay interest on some market bonds. This information came from a letter from the German company DMSA, which you can find at this link. As a result of this breach, DMSA stated that they are preparing bankruptcy proceedings against Evergrande Group, and invited other investors in possession of bonds to join this process.

However, it has also been reported that the China Evergrande Group paid a portion of the $148.13 million in interest to its investors. Although the DMSA company says it did not receive the payment due, a representative of the Clearstream company told the Bloomberg that DMSA effectively money from the interest on the bonds issued by the Chinese company.

Clearstream is a company dedicated to providing post-trade infrastructure and securities services for clients in 110 countries. According to Bloomberg, it was possible to confirm that other investors who own bonds such as those of DMSA did indeed receive the payment that was due to them, but specific information was not provided on the identity of these alleged investors.

The news of the bankruptcy procedure that DMSA will initiate against Evergrande seems to have scared some investors who see in this situation a problem that could affect the world economy. It is well known that Evergrande is going through significant financial problems and for several months it has been speculated whether they will be able to meet the payments to investors in possession of the bonds issued.

Evergrande is not a company that is dedicated to the cryptocurrency business, but being one of the financial giants in the world, what happens to this company will definitely affect the rest of the markets.

What will happen from now?

Well, we will have to wait to see what happens in the next hours/days. The Evergrande company is definitely big enough to impact the world economy and at this time it is not known for sure if what DMSA says is correct or not.

The Chinese government has gone out to do damage control by implementing mechanisms to prevent companies like Evergrande from going bankrupt. Yesterday it was reported in Security Times, a media controlled by the Chinese state, that the rules for developers to issue domestic bonds could be relaxed in order to help them face their debts.

One of the biggest fears raised by the possible bankruptcy of Evergrande is that there will be a “domino effect” that affects the entire country, as it would force creditors to bear the costs and ruin hundreds of companies. Therefore, analysts trust the Chinese government to intervene to minimize this national impact.

Regarding this situation, we will have to be pending to see what happens with DMSA’s intentions to seek the bankruptcy of Evergrande. In addition, it must be taken into account that during the coming weeks and months Evergrande will have to meet several interest payment dates to investors for the bonds issued. If the company fails to issue those payments the situation will get worse and world markets will definitely be affected.

My personal opinion

Before giving my opinion, I must remind you that I am not a financial analyst and that I have no training in banking, finance or anything like that. I am simply an engineer and I invest in cryptocurrencies. The information compiled in this post should not be taken into account to make investments of any kind. Remember that your money could be at risk.

By profession I am a researcher and as such I like to sit down to analyze case studies on events that occur around me. In this case, it is something that has affected my investments in cryptocurrencies and as such I consider that it does not hurt to share my particular opinion.

In this case, I believe that this phenomenon is part of the “natural disasters” that occur in investment markets, although I must say that what happened yesterday would hardly become a long-term problem. Evergrande is too big and too important a company to go bankrupt. The Chinese government has a duty and an obligation to protect these types of companies, since in the case of Evergrande it is an employer that employs 200,000 workers directly and 3.8 million indirectly, according to this article. This company has sold houses to more than 12 million owners.

The Evergrande bankruptcy would have catastrophic effects for China and the rest of the world. And at a time like this when we are trying to recover from difficult times caused by the COVID-19 pandemic, such a financial disaster is the last thing China and the world need.

The fall in the cryptocurrency market was probably due to the fear of some investors who see the Evergrande situation as a problem of global magnitude. In times of crisis it is imperative to have cash, as stock markets become volatile and devaluations occur on all assets. Fear leads people to want to withdraw their investments and capitalize on their assets before the crisis worsens.

In any case, I consider that this is a good time to take advantage of the drop in the price of some assets to make purchases. The total market value of cryptocurrencies fell to 200 trillion dollars, from an all-time high of close to 3,000 trillion to 2,750 trillion. Eventually the market will recover, probably within a few days, and investments made at this time of price reduction will pay dividends.

I hope the information in this article is helpful to you. Any questions or comments are welcome in the comment box.