More than 1 year has passed since that October 28, 2021, the day on which Shiba Inu reached its maximum historical price (0.00008845 USD/SHIB). Since then it has lost 89.52% of its value, reaching 0.000009277 USD/SHIB at the time I am writing this post.

I must clarify that I am not writing this post to speak ill of cryptocurrencies. Right now it seems that no one wants to know anything about that, as the market in general has lost most of its value in the last 12 months. But the same can be said of many other companies around the world that have seen their value reduced during 2022.

For example, Netflix shares were worth $700 in November 2021, but today they are worth $304. That’s a 56.7% loss in value. At some point in May the shares were worth $164, the equivalent of a 76.5% loss.

And Netflix is not the only example. Amazon investors saw their shares fall from $188 in November 2021 to just under $86 in November of this year, a loss of around 55%. In the same period, Google shares have lost 45% of their value, Microsoft 38%, Tesla 60%, Meta (Facebook, Instagram, WhatsApp) 75%. This is just to mention some very specific cases.

Bitcoin, for its part, has lost around 75% of its value. Bitcoin, like the rest of the cryptocurrencies, is considered a risky investment, which are the first assets that investors sell in times of crisis. Even under this premise, BTC price losses are on par with tech giants like Netflix and Meta. In case you haven’t noticed, the world is in crisis and that’s how it has been throughout the year 2022.

But the objective of this post is not to talk about the economic crisis. Nor do I want to make firewood with the fallen tree with Shiba Inu, who has lost most of his value during this year. The same has happened to many other companies, so it is not about selling Shiba Inu and cryptocurrencies as a scam.

What I want to focus on in this post is to follow up on the Shiba Inu token burning process. I remember that at the moment it reached its ATH, the hope of the holders to become millionaires was set on burning tokens. Since the unit price is so low, millions of tokens can be bought at a relatively affordable price for ordinary people. Today, $1,000 buys 107,816,711 SHIBs. With 1020 dollars you can buy the 110 million units.

Imagine that one day the price of SHIB rises to 1 cent. That $1,000 will have turned into $1.1 million. It doesn’t even have to be worth a penny, just 0.1 cents is enough to make a significant amount of money.

But mathematically it is impossible for this to happen. Last year I wrote a post dedicated to analyzing the amount of money that would need to be invested for the price to rise to 1 cent:

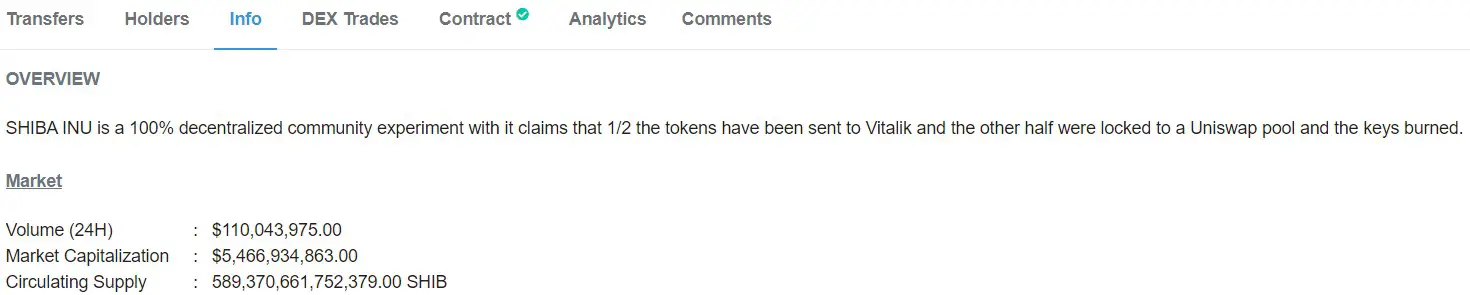

Basically there is no money on Planet Earth for the price of Shiba to rise to 1 dollar. 1 cent? It’s still very difficult. With today’s market cap, some 589,735,030,408,323 SHIB, a market cap of 5,897,350,304,083 would be needed. That’s… 5.897 trillion dollars.

To put it in perspective, Elon Musk bought Twitter for $44 billion. Shiba Inu would have to fetch a market value almost 135 times what Musk paid. So no, the dream of the Market Cap going high enough for Shiba Inu to hit 1 cent WILL NOT HAPPEN.

Unless… the amount of SHIB is suddenly reduced to an amount where the price is likely to go up to a penny. With Shiba’s market cap today (5,090,970,773 or just over 5 billion) the amount of SHIB should be 509,097,077,300 or the same as 509 billion tokens.

As of today, the number of SHIBs in circulation is 589,391,673,493,260 according to etherscan. That is 1157 times more than what should be in circulation for the dream to come true.

Last year I built a tool to count the number of tokens on the etherscan page day after day to see how many are going out of circulation over time. The tool is available in this post:

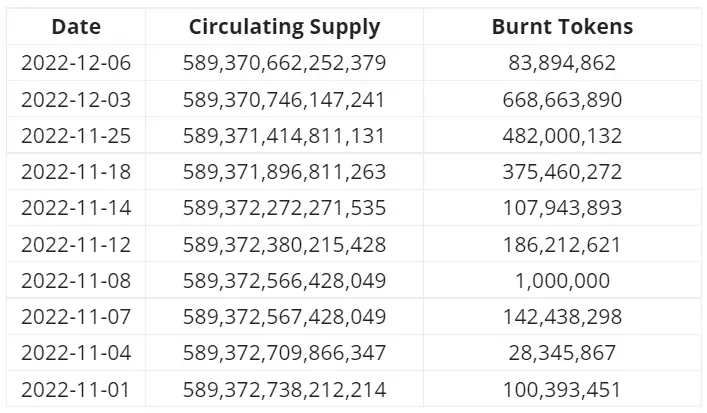

In recent days these have been the amounts that have been burned:

The script sometimes takes a few days between each verification process, but generally it keeps working. The first time I ran this algorithm, on November 8, 2021, the number of registered tokens in etherscan was 549,152,679,474,417. That’s 549 trillion tokens.

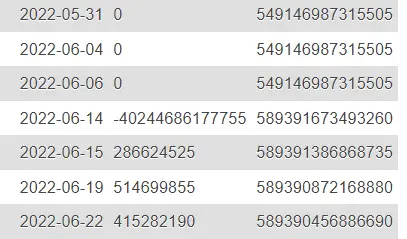

As of today the amount of tokens is 589,370,661,752,379. That is 40,217,982,277,962 (40 trillion) more than when I started counting them. For some reason on June 14, 40 trillion tokens appeared on Etherscan, just like that.

For those days the price of Shiba fell by 32%. The supply increased by around 7%, so that price drop could have been affected by that event. I don’t know what happened, but the tokens showed up on etherscan. It probably has to do with the source that etherscan uses to present this data, which is Coinmarketcap.

Since then, from June to the present, the supply has been reduced from 589,391,673,493,260 to 589,370,661,752,379, about 21,011,740,881 fewer (21 billion tokens). That in 175 days, from June 14 to today. At Shiba’s price today, those burned tokens represent $195,199.

If for every 175 days 21 billion tokens are burned, as has happened in this period, it will take 4,904,437 days to achieve the goal of reducing the circulating supply to 509,097,077,300. The 4.9 million days is 13436 years.

In conclusion, Shiba Inu is NOT going to reach a unit price of 1 cent. It will NOT happen from an increase in market cap and it will NOT happen from a reduction in the amount of tokens burned either. At least not under the conditions we know today.

I hope this analysis has been useful to you. I am sorry that some of my readers may find this analysis disappointing, but I have simply stated the facts based on the information available to us at this time.

Any questions or comments can be sent to me through the comments.